Advertisement

-

Banking

BankingBenefits of a Good Credit Score

Feb 24, 202494179 -

Investment

InvestmentAlphabet Stock

Feb 24, 202452622 -

Mortgages

MortgagesMoving to New Mexico: Things to Know

Feb 12, 202464838

-

Know-how

Know-howSafeguarding Your Wealth: Techniques for Hiding Assets from Public Record

Discover legal ways to hide your assets from public records, the reasons for doing so, and how financial advisors can assist in protecting your wealth.

Dec 20, 202339553 -

Know-how

Know-howDemystifying Estate Planning: The Differences Between a Will and a Trust

Explore the essential differences between a will and a trust in estate planning. Learn about their benefits, pitfalls, and key factors to consider in making an informed decision.

Dec 20, 202374328 -

Know-how

Know-howTypes of Business Licenses: How To Get Them?

If you are just starting out as a new business, getting the required business licenses is the first critical step. Please read the article to find out more about it.

Dec 20, 202322390 -

Mortgages

MortgagesHow To Recognize Debt Collection Frauds

Unsolicited phone calls, aggressive tactics, false information, untraceable payment methods, and requests for personal information can identify debt collection scams. To avoid falling victim to these scams, verify the debt and collector, report any suspicious activity, and never provide personal or financial information. Stay vigilant and always be cautious of red flags to protect yourself from fraudulent debt collectors.

Dec 18, 202340307 -

Know-how

Know-howUnveiling the Hidden Costs of Renewable Energy

This article evaluates the hidden costs of renewable energy, considering environmental, economic, and social implications to ensure a truly sustainable transition.

Dec 17, 202323564 -

Investment

InvestmentReason Day-Of-The-Week Investing Is a No-Go Strategy

Day-of-the-week investing is a no-go strategy. While it may seem like a simple and effective way to profit, it's important to remember that past performance does not indicate future results, and transaction costs can quickly eat into your returns. The theory behind this strategy is that certain days of the week have historically produced better returns than others. For example, the strategy suggests buying stocks on Mondays and selling them on Fridays, as Mondays tend to be the lowest-performing days while Fridays tend to be the highest-performing

Dec 16, 202361478 -

Investment

InvestmentDay Trading: What Is a Pattern

The term "pattern day trading" describes purchasing and selling stocks more than four times in five days, all within the same trading day. The Securities and Exchange Commission (SEC) strictly governs this form of trading, and brokers can't let you trade unless you have at least $25,000 in your account. Some restrictions and regulations, such as keeping minimum equity and margin levels, also apply to pattern day traders.

Dec 16, 202348726 -

Know-how

Know-howUnraveling the Decline in American Manufacturing Efficiency: A Closer Look

This article explores the complex challenges facing the American manufacturing sector, including globalization, technological changes, and environmental regulations.

Dec 16, 202359733 -

Banking

BankingThe Vanishing Act: Understanding the 7 Reasons Why People Prefer Digital Transactions Over Checks

Embark on a journey to explore the seismic shift away from conventional checks towards the realm of digital transactions. This article unveils the core reasons underpinning this transformation, shedding light on the dominance of online payments and the revolution brought forth by mobile banking.

Dec 16, 202340707 -

Investment

InvestmentChoosing Your Financial Ally: Betterment vs. Robinhood

Discover the nuances between Betterment and Robinhood to make informed investment choices. Uncover the strengths of each platform and find which aligns better with your financial goals.

Dec 15, 202336436 -

Investment

InvestmentDecoding Investment Possibilities: The 10 Best Stock Trading Websites

Explore the dynamic world of investing with our guide to the top 10 stock trading websites. Designed for beginners, discover user-friendly interfaces and advanced tools to find your perfect platform for a successful investment journey.

Dec 14, 202322945 -

Know-how

Know-howWhat is Communism? Learn its History and Principles

Discover the essence of communism – its definition and principles explained in simple terms. Explore the foundations of this economic system.

Dec 04, 202395027 -

Know-how

Know-howUnderstanding Capitalism: A Simple Guide to Economic Basics

Discover the definition of capitalism in our extensive guide and unlock the secrets of a sustained economic future.

Dec 04, 202368474 -

Know-how

Know-howA Simple Guide to Inelastic Demand

Unlock the secrets of inelastic demand by having a closer look at our guide, focusing on the consumer’s choices. Learn how fluctuations in the cost don’t affect the sales of an item.

Dec 04, 20238794 -

Know-how

Know-howMonopoly – Types, Examples and Much More

If you are curious to know what Monopoly is and how it works, then make sure you read this article.

Dec 04, 202328352 -

Investment

InvestmentCan You Make A Tax- Free Investment

To accumulate wealth over time, investing is essential. Understandably, investors would want to minimize their tax liability in light of rising inflation and a cloudy economic forecast

Nov 29, 202391216 -

Mortgages

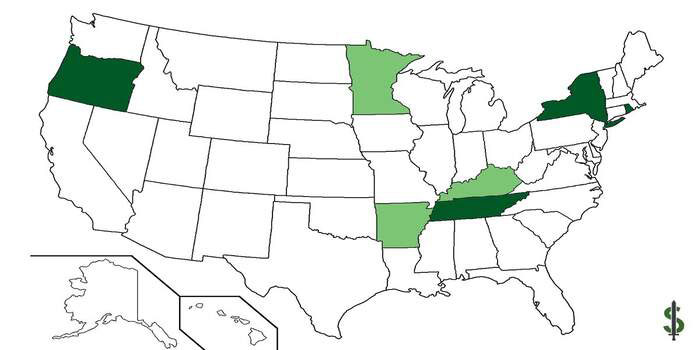

MortgagesAssistance For First-Time Homebuyers In The State Of Kentucky

Living costs and home prices in Kentucky are far cheaper than the national average, making it easy to enjoy a reasonable standard of living without breaking the bank. Apart from being the site of the prestigious Kentucky Derby horse competition each year, Kentucky has a solid economy thanks to its booming shipping, transportation, automotive, healthcare, and bourbon distillery industries

Nov 28, 202383767 -

Investment

InvestmentWhat You Need To Know About Invest During A Recession

Experts are arguing whether or not the United States has entered a recession amid rising inflation, falling stock prices, and negative gross domestic product (GDP). Though the answer to that issue is still up in the air, you may wonder what you can do to prepare your finances for the possibility of rough economic times ahead. Investing during a recession: here is everything you need to know. There is no such thing as a "recession-proof" transaction, but your portfolio may be strengthened by including certain companies, ETFs, and methods. Defining a recession is important before considering assets that can weather economic downturns. If GDP declines in two consecutive quarters, we say the economy is technically in a recession.

Nov 25, 202319589 -

Taxes

TaxesUse Your Tax-Deferred Retirement Savings To Their Full Potential

401(k)s and individual retirement accounts (IRAs) are tax-advantaged retirement plans that can help you save for retirement with less tax bite. You should put as much money into these accounts, take advantage of any matching funds your employer offers, and consider making standard and Roth contributions. Your investment allocations should be reviewed and rebalanced regularly to ensure they continue to support your long-term objectives.

Nov 07, 202317846 -

Banking

BankingWhat Are Community Development Financial Institutions: A Complete Guide

A Community Development Financial Institution, or CDFI, is a private bank that helps poorer communities become more financially stable and grow their economies. With a focus on the local area, CDFIs look for communities that aren't well served by traditional banks. CDFIs often care more about social responsibility and inclusion than just making money, and the federal government's CDFI Fund may help them

Nov 07, 202320926 -

Investment

InvestmentTrading Stocks without a Broker

Are you looking for an easier, more affordable way to trade stocks? Discover how trading stocks without a broker can open up your investing opportunities and save money.

Nov 03, 202397915 -

Investment

InvestmentTop No-Transaction-Fee Investment Firms

The best no-load mutual fund companies provide a large range of low-cost options without burden. This implies that the best mutual funds are available from these companies without the added expense of commissions, sales fees, or 12b-1 fees. With mutual funds, investing is easier and more accessible to more people

Nov 01, 202366311 -

Investment

InvestmentHow Do Increases In The Fed's Interest Rates Impact Stocks?

In addition to variables like the economy, business profitability, and industry, the link between Fed rate rises, and equities may be complex. Even though people react negatively to interest rate increases initially, they may get used to them over time. Investors should establish a plan considering their risk tolerance and the outcomes they want to achieve.

Oct 18, 202367804 -

Investment

InvestmentIdeal Low-Risk Investments For The Month Of October, 2022

These goods aren't FDIC-insured. Therefore, you can lose money. You may be willing to take on greater risk for bigger returns on liquid, easy-to-access products. Before investing additional cash, you may need in a situation build up an emergency fund

Oct 16, 202337557 -

Banking

BankingWork of Credit Card Grace Periods

No interest will be added to your purchase price while the grace period is active. There is a buffer of 21 days between when your credit card bill is generated and when payment is actually due. Although the notion itself is straightforward, explaining whether or not you have a grace period this month depends on your actions in the prior two months.

Oct 09, 202330156 -

Taxes

TaxesTax Treatment Of Gits Made To Spouse

Gifts made to your spouse are not taxable. However, you may still need to mention it on your tax return.

Oct 09, 202375416 -

Banking

BankingSome Information About the Barclays Apple Credit Card

Barclays is eliminating the last of the Apple Rewards Visa card on May 7th, marking the official end of the program. Apple stopped offering special financing to Barclays cardholders in September 2020, recommending instead that customers use the Apple Card.

Oct 07, 202316271 -

Mortgages

MortgagesJumbo vs. conventional loan

Find out what potential borrowers should consider when deciding between a jumbo and conventional loan, as well as which one might be best for your circumstances! Get informed details on jumbo vs. conventional loans today to make an informed decision about financing your dream home with ARM Mortgages.

Oct 07, 202384688 -

Investment

InvestmentThe Increase In Popularity Of Self-Directed Investment

There has been a recent uptick in the number of people handling their investment portfolios rather than using the services of a financial counselor or broker. The proliferation of online trading platforms has given investors unprecedented access to data and analytical tools. This method gives investors more say over their holdings, boosting efficiency and returns.

Oct 06, 202310402

-

What Differentiates Mutual Funds Around the World

Investment -

Exploring the 12 Best Real Estate Crowdfunding Platforms in 2023

Investment -

What Is Check Representment?: A Complete Guide

Banking -

All About Amsterdam Stock Exchange: Structure and Operations

Investment

-

Everything You Should Know About 3C1 and The Exemption Application

Dec 28, 20234556 -

List of the Best States With Free College Programs

Dec 27, 202356533 -

Discontinued 1040EZ Form: History and Reasons for Its Phase-Out

Dec 25, 202374955 -

Is It Necessary To Have A Registered Agent For Your Business Operation

Dec 22, 202328710