how fed rate hikes tomorrow will affect retail stocks? As the United States central bank, the Federal Reserve (Fed) makes monetary policy choices that have wide-ranging effects on the economy and financial markets. One of the most effective tools in the Fed's arsenal is changing its federal funds' rate, which determines the interest that financial institutions can lend to one another overnight. Changing the federal funds rate may have far-reaching effects on the economy. This paper will analyze the correlation between Fed rate rises and stock prices, including its underlying causes, past manifestations, and future consequences.

Mechanism of Fed Rate Hikes

Several factors are at play in the intricate link between Fed rate rises and equities. As interest rates rise, it costs businesses and individuals more to borrow money, which often results in less discretionary expenditure and less capital being invested. Hence, increased interest rates may hurt stock values by slowing the development of companies' profits and revenues.

Investment opportunity cost is another way. Investors are more inclined to put their money into equities at low-interest rates since the returns are better than those on fixed-income investments. Investors may move their money out of equities and into bonds or other interest-bearing assets if interest rates increase and make the rewards on these securities more attractive. This change in capital allocation can lower stock prices by reducing demand for equities.

Historical Evidence

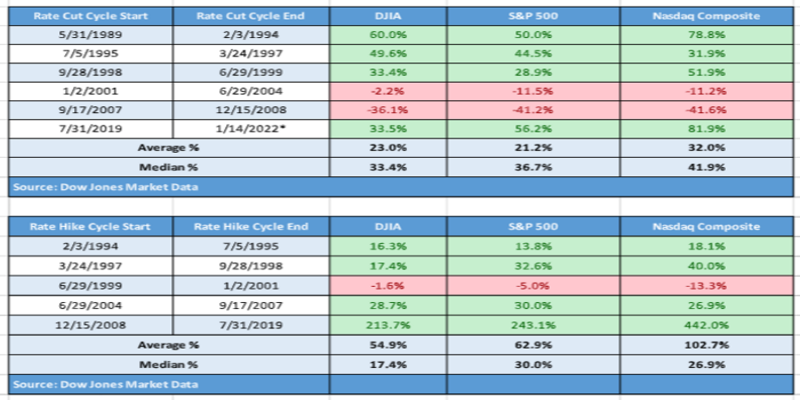

Equity markets may or may not react negatively to a Fed rate hike, depending on the specifics of the economy at the time. The market usually reacts badly to the first few rate rises in a tightening cycle, although the effect of future hikes may be less severe. For instance, the Fed hiked the federal funds rate from 3% to 6% in the 1994-1995 tightening cycle, which led to a severe drop in stock prices. Some well-known hedge funds and institutions and the S&P 500 had significant losses in 1994. Despite this early setback, the market eventually rebounded, and equities posted substantial gains over the following several years.

The Federal Reserve increased interest rates from 1% to 5.25% during the tightening period of 2004-2006. The first reaction from the market was unfavorable, and the S&P 500 dropped by more than 8% in 2004. Yet, the market found its footing, and shares of the stock rose steadily over the subsequent two years. The market's response to the tightening cycle between 2015 and 2018 was less unanimous. Multiple market turbulence and sell-offs episodes occurred when the Fed increased interest rates from near-zero levels to 2.25-2.50%. Concerns over the effect of increased interest rates on corporate profitability and the economy contributed to a more than 10% drop in the S&P 500 in late 2018.

Implications

Stock market reactions to Fed rate increases are rarely predictable and may be affected by several variables. For instance, if economic growth and business profits are good, the market may be less sensitive to interest rate increases. Also, the market may be less volatile if the Fed correctly announces its goals and steadily increases rates instead of surprising the market with rapid rate hikes. Stocks' reactions to Fed rate increases vary widely across sectors and industries. For instance, companies in the interest-sensitive utilities and real estate industries may be more at risk from rising interest rates than those in the information technology and healthcare sectors. The degree to which businesses and customers are in debt may also influence the nature of the connection. High-debt businesses and people may be more vulnerable to interest rate fluctuations than their lower-debt counterparts.

Conclusion

Stock prices and Fed rate rises have a complicated connection driven by several variables. Increases in the cost of borrowing by businesses and individuals may hurt economic activity by discouraging investment and consumer expenditure. The opportunity cost of investing may rise when interest rates rise, prompting some people to rebalance their portfolios away from equities and toward fixed-income instruments. Markets have shown an adverse reaction to first-rate rises during a tightening cycle, but successive hikes may have less effect. However, the market's reaction might change based on the state of the economy, the performance of corporations, and other variables. Stock reactions to Fed rate rises may also differ by industry and sector and be affected by corporate and consumer debt levels.